News archive - How are OECD countries designing R&D tax relief & what's its cost?

Member States & partners are increasingly using R&D tax incentives to support R&D in firms

In April 2021: Release of the 2020 edition of the OECD R&D tax incentive country profiles. These extended profiles provide the most up-to-date internationally comparable information – qualitative and quantitative – on the design and cost of R&D tax relief provisions used by countries to incentivise business R&D. Drawing on the latest indicators of government tax relief for R&D from the OECD R&D Tax Incentives database, updated in March 2021, they highlight recent and long-term trends in the role of R&D tax incentives in the innovation policy mix across OECD countries and partner economies.

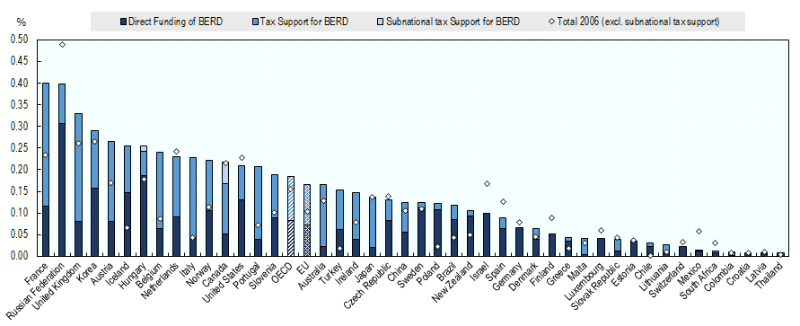

Direct government funding and tax support for business R&D, 2018

As a percentage of GDP

Source: OECD R&D Tax Incentives Database, March 2021 | Data and notes

Check out the updated country profiles, latest information & international comparison: https://www.oecd.org/sti/rd-tax-stats.htm

- European Union (EU 27)

- Western Balkans

- Cross-thematic/Interdisciplinary

Entry created by Admin WBC-RTI.info on April 19, 2021

Modified on April 19, 2021